Trading platforms for cryptocurrencies are online marketplaces where users may purchase, sell, and trade various cryptocurrencies. They facilitate transactions by connecting buyers and sellers and keeping sensitive information safe.

Users may trade several cryptocurrencies on these sites, which function similarly to conventional stock markets. There is a wide variety of cryptocurrencies available for trading on this cryptocurrency trading platform, from Ethereum and Bitcoin to more obscure altcoins.

How Crypto Investing and Crypto Trading Are Different In Cryptocurrency Trading Platform?

If you want to learn about buying and selling digital assets, you must go into cryptocurrency. You may be curious about how to learn about crypto trading amidst all this information. This is why you must educate yourself on the distinction between crypto investment and crypto trading. The superior choice between the two must also be recognized. Making more money is the end goal of every trader and investor.

There is a big difference in the expected durations of the results. Traders consider this time frame as medium to short. You, as a crypto investor, will be purchasing and holding digital assets for a long time, maybe even years. Crypto traders, on the other hand, often maintain a position for a matter of seconds to weeks

Tips Before Choosing a Crypto Exchange On Cryptocurrency Trading Platform

Crypto exchanges might get you into problems if you aren’t careful while choosing one. The idea of a cryptocurrency exchange is straightforward: a marketplace where users can purchase and sell various cryptocurrencies via a cryptocurrency trading platform. However, just like everything else in the crypto verse, exchanges may be intricate and may need more investigation than conventional stock due to its lack of regulation. To protect yourself from potentially disastrous situations involving fraudulent cryptocurrency exchanges or fraudsters, consider the following:

- Verify the company’s registration status as a securities broker

- A genuine LinkedIn, Twitter, or Facebook profile should be part of the trade

- Before choosing a cryptocurrency exchange, be sure to look at their customer care system. Call their toll-free number or use their chat feature to get in touch.

Strategy for Trading Cryptocurrencies On Cryptocurrency Trading Platform

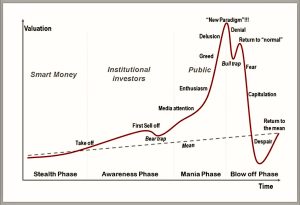

Researching the market is an excellent place to start when deciding on a trading strategy. Without a strategy, traders are more prone to getting caught up in social media hype and losing money. Diversifying your portfolio over many cryptocurrencies is another smart move to protect yourself from sudden price drops.

- Day trading – Day traders go in and out of transactions all day long. To profit from price swings, this trading method entails continuously and persistently watching the market. Crypto traders may use technical indicators to better plan their entry and exit strategies

- Scalping- To make a profit, even if it’s only a tiny amount from each trade, scalping entails trading many transactions. The typical day for a scalper is filled with new transactions. Due to their high trading frequency, scalpers might see their profits build up throughout the day

- Momentum trading – Capitalizing on trends throughout time, whether they’re rising or falling, is what momentum trading is all about. Its users are the ones who reap the rewards of crypto momentum, which may manifest as surges in the price of a coin due to its sudden rise in popularity or widespread media coverage

- Swing trading – Taking advantage of expected market swings, swing traders engage in trades that run anywhere from one day to one month. Technical analysis, used by swing traders, examines significant price changes in the near term. But the method isn’t without its dangers; crypto prices could fluctuate wildly over the weekend or even throughout the night.

Simple Steps to Start Trading Crypto Exchange from Cryptocurrency Trading Platform

Trading cryptocurrencies through cryptocurrency trading platform, like stocks and other financial markets, can be complicated. To begin, it is essential to know about the trading and technology involved.

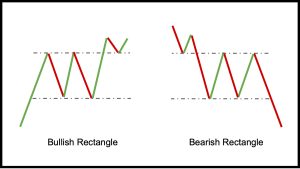

Bullish Rectangle:- The bullish rectangle shape you find on a cryptocurrency trading platform is determined when the cost moves sideways, skipping between these two equal lines and framing a crate-like shape. Break out of the cost over the upper obstruction level happens, and its upturn proceeds.

Bearish Rectangle:- A bearish rectangle shape is framed on a cryptocurrency trading platform when the cost combines for some time during a downtrend. This happens because vendors most likely need to interrupt slow down and rest before taking the pair any lower. In this model, cost broke the lower part of the square-shaped outline design and kept on destroying it. There are five stages to go through before you start trading cryptocurrencies:

- Make a Record on a Crypto Trade Stage:- Trading cryptocurrencies is more involved than just buying tokens with your bank account. To begin trading cryptocurrencies, one must first create an account with a crypto exchange.

- You Can Now Fund Your Account:- Funding your cryptocurrency exchange account is the next step after setting it up. Linking your bank and trading accounts is the simplest method to achieve it. Next, you may move actual cash by depositing it into a bank account, using a debit card, or sending a wire transfer. Due to the low or nonexistent costs associated with wire transfers, they are usually the most cost-effective method of funding your account. Fees for trading in different cryptocurrency trading platform may vary.

- Choose a Cryptocurrency To Buy Or Sell:- Bitcoin and Ethereum, two of the strongest cryptocurrencies currently accessible, are the most popular among traders. However, you may choose among thousands of different cryptocurrencies that are expanding at a rapid pace. Managing your risks, doing market and technical research, and looking at the cryptocurrency’s market size are all important considerations when making your choice.

- Select a Plan:- Trading, in general, is filled with danger and potential problems, so even seasoned traders realize they need a plan when dealing with stocks. When it comes to trading, a strategy is a plan or roadmap that you create to help you stay on track and reduce financial risks.

- Begin Your Trading Journey:- After deciding which cryptocurrency to trade via a cryptocurrency trading platform and formulating a plan that takes into account your risk tolerance, level of expertise, and other factors, the next step is actually to trade. Cryptocurrency trading may be done manually or automatically. The best and easiest solution is to use trading bots to automate this procedure.

Conclusion

Cryptocurrency trading platform are vital to the cryptocurrency ecosystem because they allow new investors to enter the market. You may make educated judgments and reach your trading potential by learning how different platforms function and what features to seek when selecting one. The correct cryptocurrency trading platform may assist investors of all skill levels in reaching their financial objectives.

Finance Conductor provides detailed analysis with weekly blogs every month.